Advisers to investment companies under the Investment Company Act of 1940.Have $100,000,000 or more in client assets under regular and ongoing management and can also include:.State investment adviser registrants also include investment advisers offering services that solely include financial planning or soliciting clients on behalf of other advisers.Have less than $100,000,000 in assets under management.Engages in a regular business of providing advice about securities.Īdvisers must register or become licensed with either state or federal securities regulators, based on the following:.

PRINCIPAL DEFINITION SECURITIES INDUSTRY REGISTRATION

Investment Adviser and Investment Adviser Representative Registration

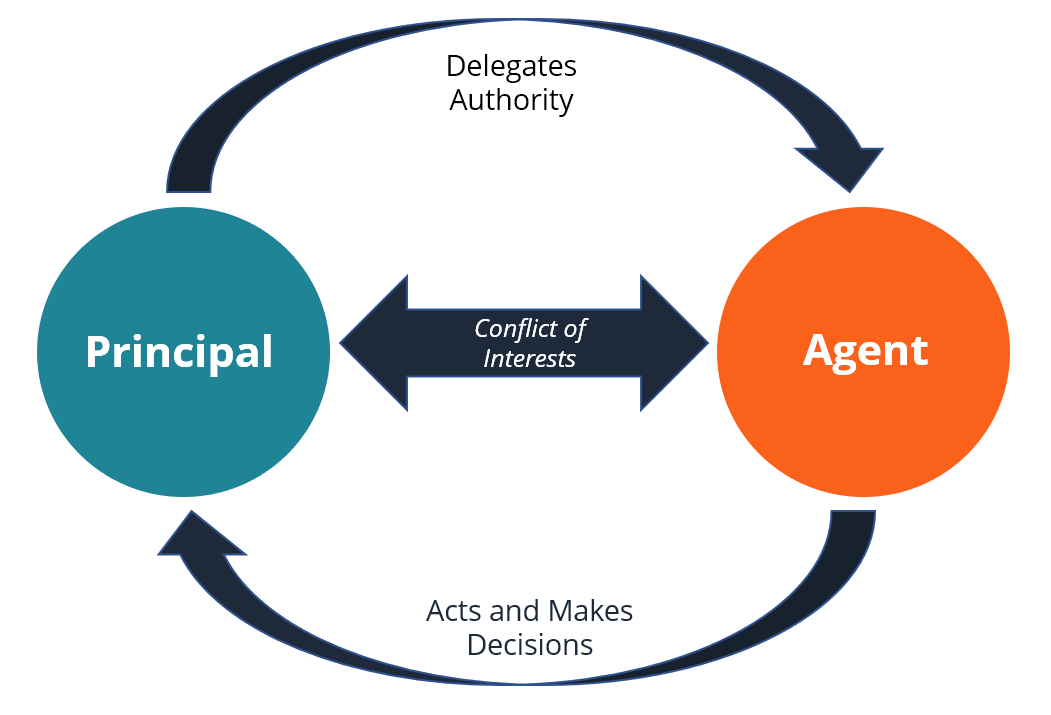

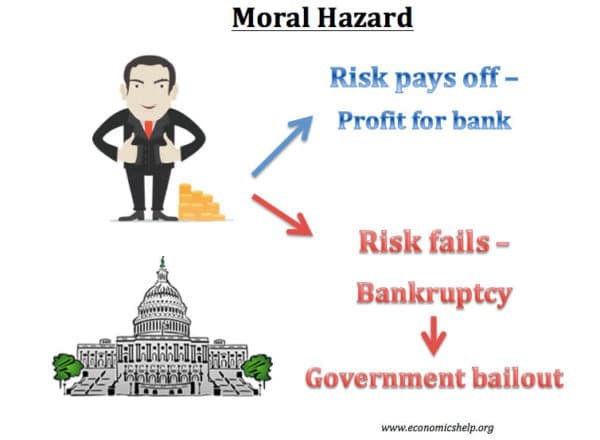

Investment Adviser & Investment Adviser Representative Registration.You are urged to obtain and review the federal or state laws and rules that may apply to your activities. This discussion does not purport to cover all aspects of the industry or all regulator requirements. Topics include definitions, characteristics of an investment adviser, regulators, application process, licensing periods, record keeping requirements, custody of client funds or securities, disclosure requirements, conflicts of interest, and regulator audits. The following information is intended to be a brief overview concerning the investment adviser industry.

0 kommentar(er)

0 kommentar(er)